Then a bar graph or histogram is drawn in the same area where the bar length shows movement variation in the MACD line and the signal line at single point. Then nine-day EMA will be calculated for MACD data in the same manner as above, which is called the ‘signal line’. This area is below the time axis and is divided by the 0 axis or called as centreline to show negative and positive. Then both the EMA data difference will be taken and used to draw an MACD line for the said duration and plotted as a line graph.

For calculation, refer to the exponential moving average concept.

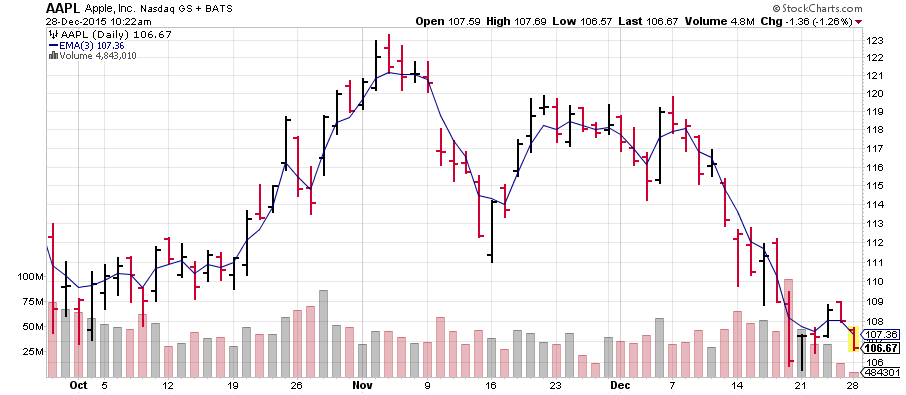

To calculate the exponential moving average of closing prices, you need to take the weighted calculation of simple moving averages, where the weighing multiplier needs to be calculated. Take the 12-day and 26-day exponential moving averages of closing prices of a security. 9-day EMAĭ) Normally a combination of 12-day and 26-day EMA of prices and 9-day EMA of divergence data is used, but these values can be changed depending on the trading goal and factorsĮ) The above data is then plotted on a chart, where the X- axis is for time and Y-axis is price, to get MACD line, signal line and histogram for the difference between the MACD and signal line, which is shown below the X-axis Long-term intervals – 21, 26, 30, 45, 50, 90, 200-day intervals 26-day & 50-day intervals are more popularī) Momentum oscillator line or divergence or MACD line – which can be simple plotting of ‘divergence’ or difference between two interval moving averagesĬ) Signal Line – which is exponential moving average of divergence data e.g. Short-term intervals – 3, 5, 7, 9, 11, 12, 14, 15-day intervals, but 9-day and 12-day durations are more popular Generally, exponential moving averages (EMA) are considered for this purpose.ĭescription: The main points for an MACD indicator are:Ī) Time period or interval – which the user can define. The simple rule for taking the two moving average is that one should be of shorter time period and the other longer time period. In MACD, ‘moving averages’ of two separate time intervals are used (most often done on historical closing prices of a security), and a momentum oscillator line is arrived at by taking the difference of the two moving averages, which is also denoted as ‘divergence’. This indicator is used to understand the momentum and its directional strength by calculating the difference between two time period intervals, which are a collection of historical time series. This was developed by Gerald Appel towards the end of 1970s. Definition: Moving average convergence divergence, or MACD, is one of the most popular tools or momentum indicators used in technical analysis.

0 kommentar(er)

0 kommentar(er)